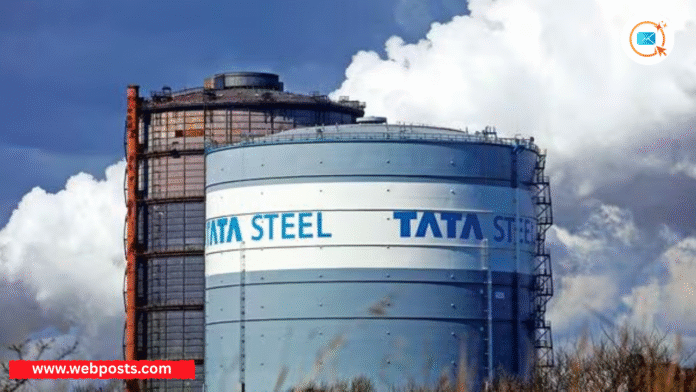

Tata Steel’s second-quarter results show a 272% increase in PAT to ₹3,102 crore and a 9% increase in revenue. The most recent quarterly results from Tata Steel are very interesting to read. Tata Steel made a net profit after tax (PAT) of ₹3,102 crore in Q2 of FY 2025-26. This was a huge 272% increase from the previous year’s Q2 profit of ₹833 crore. Its total revenue from operations, on the other hand, rose 9% from ₹53,904 crore a year ago to ₹58,689 crore.

This strong performance shows that the company can handle tough times and that the steel sector is doing well.

Key Operational Highlights of Tata Steel Q2

Strong Domestic Performance

- Domestic (India) sales were ₹34,787 crore, with EBITDA of ₹8,654 crore and a profit margin of about 25%.

Higher Steel Production and Deliveries

- India’s crude steel production rose about 8% from one quarter to the next, reaching 5.65 million tons.

- Deliveries rose about 17%, reaching 5.55 million tons.

International Operations: Netherlands & UK

- In the Netherlands, revenues were €1,551 million and EBITDA was €92 million.

- In the UK, revenues were £505 million and EBITDA was a loss of £66 million (compared to a loss of £41 million in Q1).

Capital Spending & Debt Position

- During the quarter, capital spending was ₹3,250 crore; for the half-year, it was ₹7,079 crore.

- The company’s net debt is about ₹87,040 crore.

Strategic Investment

- The Board agreed to buy 50% of Tata BlueScope Steel Private Limited for up to ₹1,100 crore.

What Is Causing the Rise in Tata Steel’s Q2 Performance?

1. Better Deliveries and Higher Domestic Demand

The 17% increase in delivery volumes in India from one quarter to the next shows stronger local market demand.

This helps lower fixed costs and raise profits. The domestic business is clearly driving growth, with a big rise in revenue and a 25% profit margin for operations in India.

2. Cost Control and Operational Leverage

The company is running its business more efficiently, as shown by its better EBITDA (up about 46% YoY) and improved margins (about 16% consolidated).

This is likely due to economies of scale, cost optimisation, and stable raw-material management.

3. Strategic Investments Driving Future Growth

Tata Steel is investing in capital (₹3,250 crore this quarter) and buying a stake in Tata BlueScope Steel to build long-term capabilities.

This could mean new products, expanded capacity, or technology upgrades.

4. Global Diversification: A Mixed Picture

While domestic operations are strong, international business is inconsistent.

The Netherlands is performing better, while the UK continues to post losses.

Volatile global steel markets, energy prices, and regulatory pressures influence this mix.

Strategic Implications and Future Outlook

Strong Investor Confidence

A 272% rise in PAT is uncommon for major steel companies.

This result may boost investor confidence and ease concerns about cyclical risks.

Margin Potential

With domestic margins near 25%, Tata Steel proves it can deliver profitable volume.

If this margin model extends to global or downstream units, potential increases.

Continued Capex Commitment

₹3,250 crore of quarterly capex shows Tata Steel is investing through the cycle, not pausing.

This positions the company strongly for future demand upticks.

Debt and Leverage Management

Despite high debt (~₹87,040 crore), rapid earnings growth may make servicing easier.

Stable cash flows will be crucial.

Global Risks Remain

Challenges include:

- High energy costs

- Carbon regulations

- Weak European demand

Management’s ability to navigate these risks matters greatly.

Key Metrics Investors Should Watch

Delivery Volumes (Domestic & Global)

Growth in deliveries improves volume leverage and margins.

Raw Material & Energy Cost Trends

Iron ore, coal, coking coal, and electricity prices strongly influence steel margins.

Value-Added Product Mix

Moving into high-margin segments (supported by Tata BlueScope acquisition) stabilises revenue cycles.

EBITDA Margins & Free Cash Flow

Tracking margin stability and free cash flow after capex + interest is essential for evaluating financial strength.

Net Debt & Leverage

Ongoing capex makes it important to monitor debt and coverage ratios.

Global & Regulatory Risks

Particularly in Europe:

- Rising energy costs

- Carbon taxes

- Weak market demand

SEO Keywords to Target

- Tata Steel Q2 results

- Tata Steel PAT up 272%

- Tata Steel revenue growth Q2

- Tata Steel FY26 Q2 analysis

- Tata Steel India performance

- Tata Steel Europe & UK operations

- Tata Steel EBITDA margin

- Tata Steel Q2 capex

- Tata Steel net debt FY26

Using these keywords naturally helps improve organic ranking and visibility.

Final Thoughts

Tata Steel’s strong Q2 performance stands out among India’s top steel producers.

A 272% rise in PAT, a 9% increase in revenue, improved margins, and strong capex all show resilience and value creation.

Despite global risks and input cost pressures, the domestic business is powering growth.

For investors and industry watchers, this quarter may represent a turning point where strong management and strategic investment start delivering real value.

Explore more interesting and insightful reads on Webposts.